lincoln ne restaurant sales tax

The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. There is no applicable county tax or.

Jimmy John S Sandwiches 1541 N 86th St Lincoln Ne Restaurant Reviews Phone Number Yelp

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

. Did South Dakota v. If you have any questions please call the Lincoln City Treasurer Monday thru Friday from 800 am to 430 pm at 402 441-7457 or use our email. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

230000 Last Sold Price. The 2018 United States Supreme. The current total local sales tax rate in Lincoln NE is 7250.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. The December 2020 total local sales tax rate was also 7250. The Nebraska state sales and use tax rate is 55 055.

The Nebraska state sales and use tax rate is 55 055. Nearby homes similar to 1929 NW 44 St have recently sold between 205K to 339K at an average of 175 per square foot. In Lincoln another 15 percent or one and a half cents is added for a city.

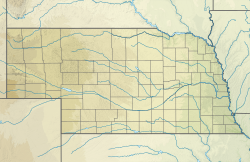

Lincoln is located within Lancaster County Nebraska. 025 lower than the maximum sales tax in NE. If you have any questions please call the Lincoln City Treasurer Monday thru Friday from 800 am to 430 pm at 402 441-7457 or use our email.

The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent. The Lincoln sales tax rate is. The average cumulative sales tax rate in Lincoln Nebraska is 688.

This includes the rates on the state county city and special levels. The Nebraska sales tax rate is currently. SOLD APR 8 2022.

Wayfair Inc affect Nebraska. The County sales tax rate is.

Here S What Happens To Your Sales Tax Gobankingrates

Prairie Plate Restaurant Photos Lincoln Nebraska Menu Prices Restaurant Reviews Facebook

1960 S Lincoln Nebraska Bishop Buffet Gateway Mall Vintage Postcard Ne Shopping Ebay

Jennifer L Schrodt Jenn29lynn Twitter

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZIS6T4KIPRFYHPF6CEFHZRGPPU.jpg)

Iowa Sales Tax Holiday Encourages Back To School Shopping

A Lincoln Ne Pioneer S Park Indian Smoke Signaler Statue Ebay

Nebraska Sales Tax Rates By City County 2022

Witherbee Neighborhood Association Lincoln Nebraska

Round Abouts Restaurant Lincoln Us Facebook

Liba Foundation To Host Annual Golf Tournament On September 3 Strictly Business Magazine Lincoln

Restaurants Prepare For New Arena Tax

Here S What Happens To Your Sales Tax Gobankingrates

Hyatt Place Lincoln Downtown Haymarket In Lincoln Ne Expedia

State And Local Sales Tax Rates 2019 Tax Foundation

237 Main St Lincoln Me 04457 Pat S Pizza Lincoln Maine Loopnet